IDEA 2019 successfully returns to Miami

Opinion

INDA President Dave Rousse said that nine new nonwoven manufacturing lines will be located in North Carolina.

9th May 2016

Adrian Wilson

|

UK

How is the global nonwovens industry faring so far in 2016?

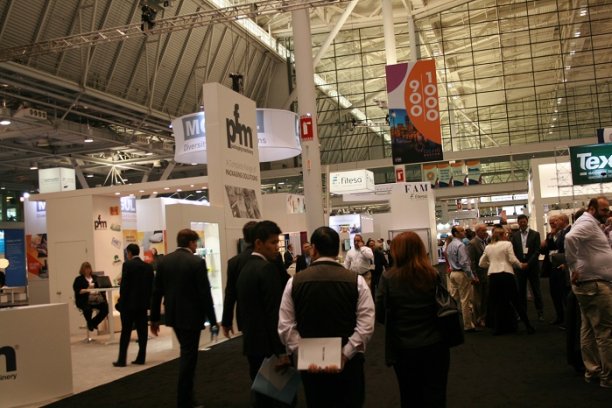

The message to be taken home from last week’s IDEA show held in Boston is that the garden is rosy almost everywhere right now, with the exceptions of South America and the Middle East.

In North America, things certainly couldn’t be better.

Speaking at the Global Nonwovens Summit, held on May 5th, the final day of the exhibition, Dave Rousse, president of show organiser INDA, said that of the 14 new North American manufacturing lines announced during 2015 and 2016, nine will be located in North Carolina.

During the show, it was announced that a tenth line – as part of a completely new $31.6 million plant – will shortly be opened in the state by a Chinese JV called Uniquetex. Meanwhile, Berry Plastics – now the world’s leading nonwovens manufacturer following its acquisition of Avintiv – is currently scouting for the location of a new US expansion to serve the hygiene industry.

Jacques Prigneaux, market analysis and economic affairs director at EDANA, reported that production in Greater Europe is also healthy, at just under 2.4 million tons in 2015 and representing 24% of global output.

Progress has been most notable in Turkey, where exports exceeded imports for the first time in 2015. In fact, the size of Turkey’s production base has grown by 6.5 times in the past decade, and during IDEA 2016, leading producer Mogul announced it had ordered no less than three full new production lines from machine builder Andritz. Two of these will be installed at the company’s new plant in Turkey, and the third for the Mogul plant in South Carolina.

Mogul was the recipient of a special Entrepreneur’s Award presented during the exhibition.

Paul Cheng of ANFA, the Asian Nonwoven Fabrics Association, said that 4.2 million tons of product was made in the region last year, with China accounting for 2.9 million tons of it – up from 1.3 million tons in 2008.

Cheng remarked on the tremendous presence of Chinese companies at IDEA 2016, representing around 30% of all exhibitors.

As far as the absorbent hygiene market is concerned, Svetlana Uduslivaia of Euromonitor asserted that global retail sales for this sector – diapers, femcare items and adult incontinence products – are now worth an annual $90 billion. Growth in Asia Pacific is an annual 8% and China’s domestic market alone will be worth $38 billion in 2020.

Brazil, meanwhile, has experienced its worst financial slump in more than a century and RISI senior economist David Katsnelson said there was no indication of an upturn in sight. Previous growth projections for nonwovens in this region now look highly unlikely, added consultant Rick Jezzi, but in the longer term there is still the potential for many markets to more than double in size.

What’s currently going on in the Middle East (MENA) – where polypropylene costs are still 20% lower than in Western Europe but the price gap has been much wider – is without doubt highly unusual.

There are 28 nonwoven producers in the MENA region, with 489,700 tons of capacity, according to David Price, of Price Hanna Consultants. The largest ten manufacturers have 65% of total regional capacity and six of them are purely spunmelt operations for the hygiene market.

In addition, there is a big market for construction materials and geotextiles which is being deeply affected by the repercussions of the current low oil price.

The demand for these materials is expected to decline by 4.6% in 2016 due to reductions in government spending on infrastructure, most notably in Saudi Arabia, Price observed.

“This market could fall even further,” he said. “Oil-dependent countries in the Gulf are dramatically reducing government spending in line with the sharp reduction in oil revenues. However, we do not expect a significant negative impact on demand for hygiene, medical or technical specialty nonwovens.”

MENA nonwovens production, however, represents just 4% of the global total, and as such, it and Brazil’s problems are just minor dark spots in what is overall a very healthy industry in 2016.

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more