Two-part DSM design for hydrogen storage

Huge capacity increases needed to meet the EU’s Green Deal goals.

18th October 2021

Innovation in Textiles

|

Brussels, Belgium

The Brussels-based European Composites Industry Association (EuCIA) is organising a series of workshops on the opportunities and challenges presented by the European Commission’s European Green Deal, which aims to make the EU climate neutral in 2050.

The first event, Opportunities for the Composites Industry within the EU Strategies on Offshore Renewable Energy and Hydrogen, took place on September 29th and connected representatives of the European composites industry with EC guest speaker Dr Carlos Eduardo Lima da Cunha, policy officer at the Directorate-General for Research and Innovation, Clean Energy Transition.

“The Green Deal will have a big impact on industry in the coming 30 years and for the composites industry there are big opportunities, but also big challenges, particularly around the circularity of materials,” said Ben Drogt, EuCIA’s managing director, who chaired the workshop. “Both the offshore renewable energy and hydrogen strategies are important because they will have direct impact on the use of composites, requiring vast increases in production capacities. The EuCIA wants to inform the European composites industry about these opportunities, stimulate discussion around the challenges, and identify sources of research and innovation support available from the European Commission.”

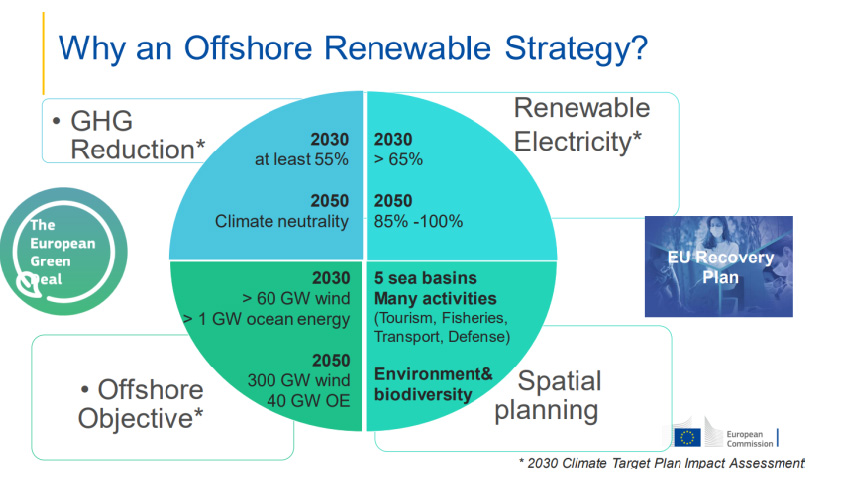

€800 billion for offshore energy

Achieving a reduction in net greenhouse gas (GHG) emissions of at least 55% by 2030, compared to 1990 levels, is a crucial milestone for the European Green Deal. In his presentation, Dr da Cunha outlined the massive expansions in offshore wind energy capacity required to reach this goal. The strategy calls for 60 GW of offshore wind capacity in Europe by 2030, rising to 300 GW in 2050. Current capacity is approximately 12 GW. There are also ambitious growth targets for ocean energy. He noted that the EC is taking a technology neutral approach, offering potential for new markets to develop around emerging technologies such as floating wind, direct current technologies, floating photovoltaic (PV), and algal biofuels.

Investment of €800 billiom

The EC estimates that to achieve its offshore energy goals an investment of €800 billion is required, most of which is expected to come from the private sector, while the EU will provide ‘catalytic’ funds.

In addition to promoting the development of renewable energy sources, the strategy aims to support research and innovation in offshore renewable energy and strengthen Europe’s technological leadership and industrial capacity. However, Dr da Cunha emphasised that this growth must take place within the context of the circular economy and improving the sustainability of composite materials is an important objective of the EC’s ongoing work.

EU production of composite materials is currently estimated to be around a million tons. The EC has calculated that to achieve 300 GW of offshore wind capacity in 2050, about four million tons of composite materials will be required for the turbine blades, nacelles and other components – assuming the same technology and materials as in 2021. This would mean, on average, a yearly additional composites production of approximately 130,000 tons, equating to 13% annual market growth. This assumes that all the composite materials for offshore installations are produced in Europe, which is not the case today.

Dr da Cunha concluded by outlining a number of challenges for the EU composites industry including:

-Safeguarding production capacity to guarantee the availability of the forecast volume of materials.

-Developing new composite materials that are recyclable, yet enable the manufacture of larger turbine blades and withstand the harsher conditions of deeper offshore waters.

-Ensuring that the EU composites sector is a reliable value chain partner in this fast growing market.

Discussions covered topics such as the circularity of materials, the capacity of existing composites recycling solutions and logistical challenges, the availability of funding to support upscaling of promising recycling technologies, potential certification of composite turbine components and the ability of the European composites industry to support this market growth.

Hydrogen strategy

The second part of the workshop addressed the EC’s hydrogen strategy. This prioritises the deployment of renewable hydrogen and focuses on two lead markets:

-Industrial applications to replace fossil energy and fossil-based hydrogen (with a focus on chemical feedstock)

-Hydrogen as direct fuel in heavy-duty road vehicles, trains, buses and other commercial fleets, and hydrogen in fuel cells for electrical mobility.

Dr da Cunha noted that the main opportunity for the composites industry centres on the safe storage of hydrogen for mobility applications, although there are also opportunities to use composite materials in hydrogen production plants and transportation pipelines. The strategy document states the amount of storage capacity required, but a vast increase in the need for high pressure tanks is expected.

Today, hydrogen storage tanks manufactured from carbon fibre composites are employed in hydrogen powered passenger cars such as the Toyota Mirai. According to the EU-funded Light Vehicle 2025 project, annual production of hydrogen cars could reach 2 million in 2030, requiring 150,000 tons of carbon fibre composites per year in globally. These volumes would require a huge step up in carbon fibre production capacity from today’s level.

Concluding the presentation, Dr da Cunha outlined similar challenges to those foreseen in the offshore renewables sector, namely:

-Developing the production capacity to meet the required volumes of storage tanks.

-Satisfying sustainability requirements.

-Becoming a reliable value chain partner in this fast growing market.

Maintaining the highest safety levels as storage demand increases is also a priority.

EU support for R&D

The EC offers funding and support for the offshore renewables and hydrogen markets through a variety of programmes, including Horizon Europe, InvestEU and NextGenerationEU. The European Clean Hydrogen Alliance and the Clean Hydrogen Partnership also support research and innovation along the hydrogen value chain.

“We, as EuCIA, will help our members connect with relevant opportunities,” said Ben Drogt. “Composites are used in many diverse end user segments, which is why EuCIA partners with downstream associations. This connection with the end user immediately creates consortia for work on specific topics. We are already collaborating effectively with WindEurope and the European boating industry, and we can look to do the same with associations dealing with hydrogen mobility. We will also continue to facilitate networking activities to explore the numerous opportunities for composites presented by other strategies linked to the Green Deal.”

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more