Chicopee releases new, improved DuraWipe

Opinion

Many of the benefits of disposable nonwoven wipes in the workplace over laundered and reusable cleaning materials (what are referred to in the US as ‘shop towels’) have been pretty well demonstrated over the past 30 years.

29th June 2012

Adrian Wilson

|

Many of the benefits of disposable nonwoven wipes in the workplace over laundered and reusable cleaning materials (what are referred to in the US as ‘shop towels’) have been pretty well demonstrated over the past 30 years.

Yet in the USA, there has been a long-running fight to level the playing field for them – to the extent that eight years ago, questions were even asked in Congress about Richard Farmer, the founder of laundered workwear and services supplier Cintas, which employs 30,000 people and had sales of $3.8 billion in 2011.

His influence as a big donor to the presidential campaign of George Bush was questioned at that time, but eventually found to be not outside the realms of acceptability.

The long-running problem for nonwoven wipes in the US stems from the 1976 US Environmental Protection Agency’s Resource Conservation and Recovery Act – RCRA – relating to the treatment, storage and disposal of hazardous waste.

Under the RCRA, most common industrial solvents are considered hazardous, and as a result of the ‘mixture’ rule, if a single drop of hazardous waste is mixed with non-hazardous material, all of that material is considered hazardous waste.

This has meant that both non-laundered wipes and rags are regarded as hazardous waste after they’ve been used with solvents and are subjected to stringent and expensive hazardous waste management requirements

Meanwhile, laundered shop towels used with the same solvents are generally not deemed waste – instead their regulation has been left to individual states, with requirements varying significantly from state-to-state and often conflicting.

Speaking at the recent World of Wipes (WOW) conference in Chicago, Jessica Franken, director for governmental affairs for INDA (the International Nonwovens and Disposables Association) explained that the non-disposable industry has used the exclusion of its products from the federal regime to its marketing advantage, pointing out that with laundered towels, RCRA requirements don’t have to be dealt with, making them both much cheaper to use and a lot less trouble.

“This has limited our industry’s ability to compete, and allowed laundered shop towels to rule the market,” she said.

Now, however, things are changing – the RCRA looks likely to be significantly amended this August.

The importance of this to the overall $5.4 billion US wipes market was underlined by INDA president Rory Holmes at the WOW meeting.

US sales of rags, shop towels and disposable nonwoven wipes were worth around $2.6 billion at retail in 2011, split between 59% industrial end-uses, 18% in healthcare, 17% in food services and 6% other speciality uses.

It’s in the general industrial markets and in food service that this new opportunity is envisaged.

The general industrial market is worth around $.1.57 billion, with $760 million currently generated by shop towels, $344 million by rags and $468 million by nonwoven disposables. In food service, shop towels account for $310 million and nonwoven wipes $132 million of the $442 million market.

So given the advantages of disposable wipes, there could shortly be a new $1+ billion market they could claim.

And this is even before taking into account the results of a new survey undertaken on behalf of Kimberly-Clark.

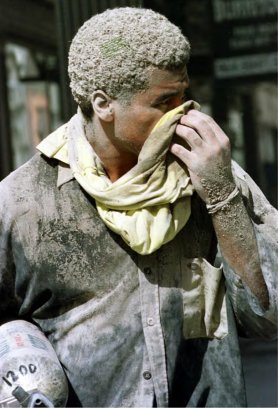

In a nutshell, this has found that laundered shop towels contain a wide variety of heavy metals, which can get onto the hands, and then be inadvertently transferred to the mouth and ingested.

These far exceed US Environmental Protection Agency health-based recommendations, and suggest that the days of the laundered towel may be numbered.

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more