Design freedom with FiberAcoustic 450

Opinion

The recently-announced bankruptcy of Konarka illustrates just how tricky it is to bring groundbreaking new technologies to market – however smart they may be. The company is the latest in a list of companies who over the past decade have attempted the fusion of technologies – in this case mass manufactured solar cells with plastic films, but the marriage of electronics with textiles is just as applicable – and come unstuck at the lengthy lead times and endless financial resources required for successfully launching such products.

6th September 2012

Adrian Wilson

|

The recently-announced bankruptcy of Konarka illustrates just how tricky it is to bring groundbreaking new technologies to market – however smart they may be.

The company is the latest in a list of companies who over the past decade have attempted the fusion of technologies – in this case mass manufactured solar cells with plastic films, but the marriage of electronics with textiles is just as applicable – and come unstuck at the lengthy lead times and endless financial resources required for successfully launching such products.

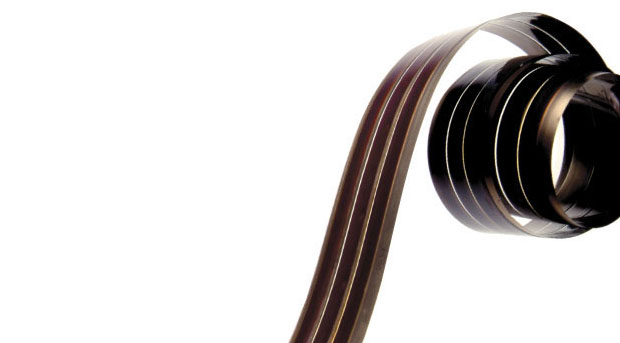

Konarka’s Power Plastic is a thin, flexible, organic solar panel that can be built into many different surfaces – even moulding to curves and contours – based on a photo-reactive polymer nanomaterial invented by company co-founder and Nobel Prize winner Dr Alan Heeger.

Founded in 2001 with a solid portfolio of patents, Konarka has attracted private funding of $170 million over the past decade, along with government contracts worth a further $20 million. In 2009 it opened a state-of-the-art manufacturing plant in New Bedford, Massachusetts, USA, where Power Plastic could be printed or coated inexpensively onto flexible substrates using conventional roll-to-roll manufacturing machines just like textiles or paper.

The company reported a steady stream of innovations, and as late as February this year, was having its latest products certified for improved efficiency. A fully-textile version of the solar technology was also under development

So it came as a surprise when on June 1, the company filed for bankruptcy protection.

“Konarka has been unable to obtain additional financing, and given its current financial condition, is unable to continue operations,” said CEO Howard Berke. “This is a tragedy for Konarka’s shareholders and employees and for the development of alternative energy in the United States.”

Mr Berke notes that several large international companies have expressed interest in financing or acquiring the company and it has not entirely given up hope that a rescue financing or acquisition will emerge.

A lack of ongoing funding has certainly hampered the progress of electronic textiles over the past ten years, with Eleksen and VivoMetrics being just two high-profile companies who’ve fallen by the wayside.

Eleksen’s touch sensitive interactive textiles were based on an electro-conductive fabric touch pad optimised for flexible, durable and rugged touch screen interfaces. In partnership with fashion brands such as Marks & Spencer, O’Neill and Zegna, the company was behind a wide range of attractive products, but by the end of 2007 had exhausted its financial reserves and was bought out by fellow UK company Peratech.

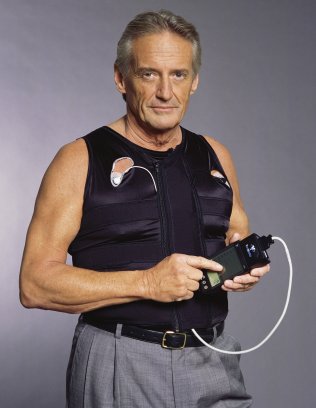

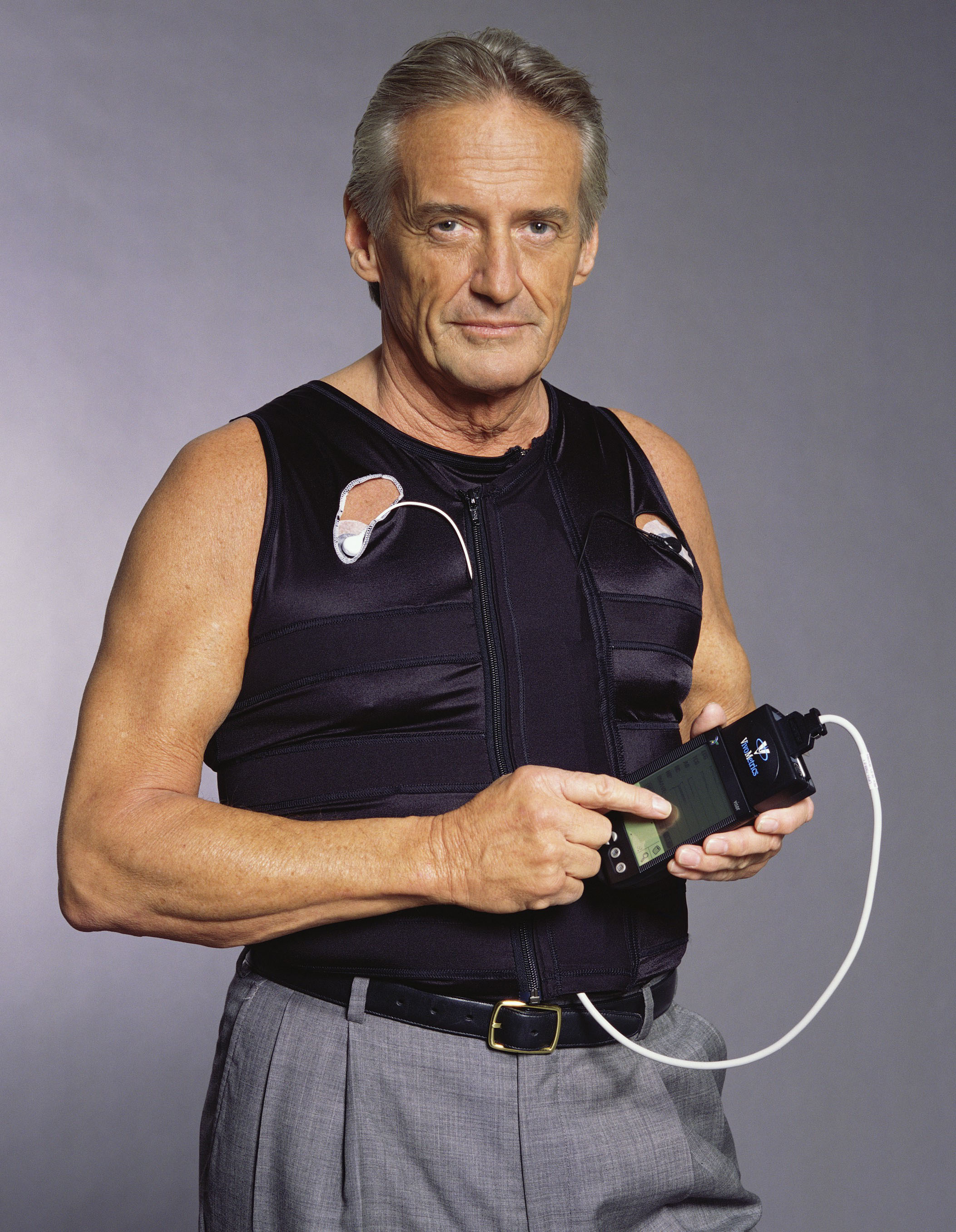

The folding of VivoMetrics in 2009 was even more surprising, given the extensive testing of its LifeShirt system for health monitoring and the highly enthusiastic response of the North American medical industry. The system was even taken to the South Pole to collect data for research into altitude sickness.

As has been noted in previous articles, the smart fabrics market is now being driven by sports giants Adidas and Nike, with a number of high profile initiatives during a sports-intensive 2012.

But even with adequate funding and proven manufacturing infrastructure in place, a relatively simple new product meeting a seemingly immediate need is not always guaranteed to succeed, as is illustrated by the case of Hong-Kong-based U-Right.

U-Right was already an established apparel manufacturer and retailer when it licensed and began promoting Texcote nanocoating technology, developed by Swedish scientists, in various Asian markets a decade ago.

Texcote is a chemical process with which nano-sized particles can be impregnated around almost any type of material. In the case of textiles, because these particles can spread upon the surface of the material evenly, the gaps in the fabric are reduced and safeguarded with a protective layer. As a result, particles such as water drops, dust, bacteria, stains and grease find it very difficult to pass through the fabric, and instead stay on the surface of the material.

The particles do not cause any damage to the protective layer and the protective function remains with the material. And because the layer is formed by such small nano-sized particles, it does not noticeably change the original character of the material, such as the shape, colour, hand, feel or smell.

By 2007 the company had installed the capacity to nanocoat a million items of clothing and home furnishings on a monthly basis at its ten-line plant in Nanchang, in Jiangxi Province, China.

The nanocoating business alone recorded a turnover of €43.9 million for the year to the end of March 2006, representing 32% of U-Right’s total sales that year, and further expansion quickly followed.

Two years later, however, the entire operation was in liquidation, with debts of over €100 million, which just goes to show that even when you do succeed in breaking a new technology, you need to know its limits.

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more