Nonwovens symposium in Dubai calls for papers

Opinion

At the recent EDANA Eurasia Nonwovens Symposium in Istanbul, the importance of conventional textile manufacturing to Turkey was underlined, in addition to the growing role of nonwovens in increasing trade with neighbouring countries.

28th May 2012

Adrian Wilson

|

Istanbul

At the recent EDANA Eurasia Nonwovens Symposium in Istanbul, the importance of conventional textile manufacturing to Turkey was underlined, in addition to the growing role of nonwovens in increasing trade with neighbouring countries.

Turkey recorded overall growth of 9.2% in 2010 and a further 8.5% in 2011 and according to Goldman Sachs, the country will become the ninth largest economy in the world and the third largest in Europe by 2050.

Exports of textiles were worth $24 billion to Turkey in 2011, representing 14.4% of all the country’s manufacturing, according to ITKIB, the Turkish Textile and Apparel Exporters’ Association.

In addition, textiles currently employ 25.5% of Turkey’s labour workforce and are instrumental in spreading wealth around a country which is heavily dominated in this respect by its capital, Istanbul.

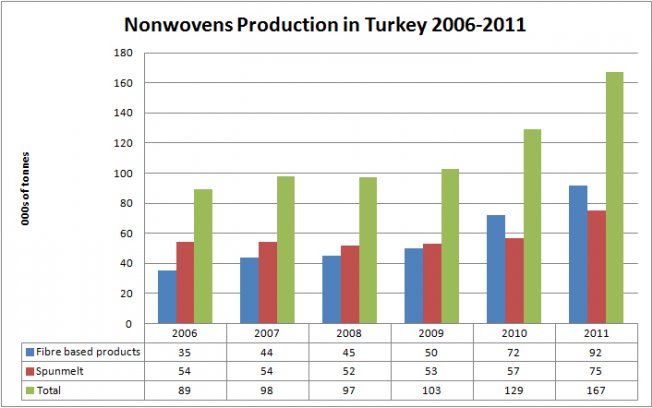

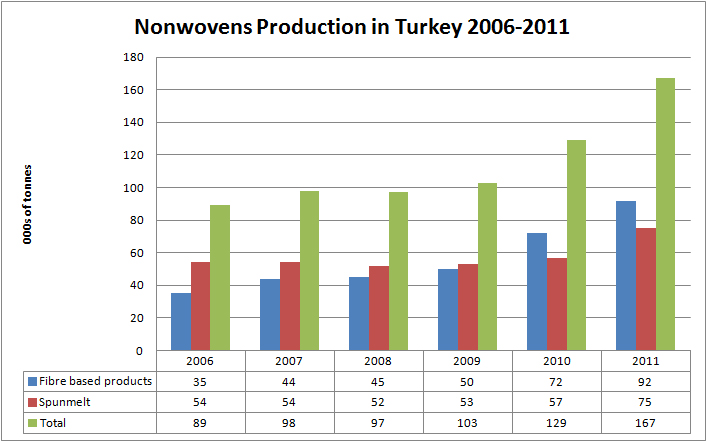

Nonwovens manufacturing, meanwhile, has grown rapidly. Jacques Prigneaux, EDANA’s Market Analysis and Economic Affairs director, put Turkish nonwovens production in 2011 at 167,000 tonnes in 2011, up from 129,000 tonnes in 2010 and 89,000 tonnes back in 2007, so the industry has more than doubled in the space of just five years.

For many years there was a shortage of diaper components being produced in Turkey – as well as materials for other disposables based on nonwovens such as femcare products and wipes – which has led to opportunities for a number of companies to step in and meet demand.

One of the leaders in this respect is Hassan Group, which over the course of the last decade has invested in a wide range of technologies, including the world’s largest thermobonding line, spunbonding and lamination units, in addition to a separate eight-metre-wide needlepunching system for geotextiles.

Most recently, Hassan has formed a subsidiary for breathable and non-breathable films and is currently installing airthrough bonded technology for the production of diaper acquisition and distribution layers (ADLs) at another new subsidiary called Merkas in Istabul.

A second leading company is Gulsan, which has now installed a new Reicofil 4 SSXMMS line at its plant in Gaziantep – Turkey’s traditional home of carpet manufacturing.

Along with two existing SMMS Reicofil lines, this gives the company an annual capacity of 60,000 tonnes of product. It also has extensive film capabilities for hygiene backsheet products and has announced plans to site a Reicofil 4, six-beam spunmelt line with an annual capacity of 20,000 tonnes in Egypt where Procter & Gamble is currently building a huge diaper plant.

General Nonwovens, which is also based in Gaziantep, is a producer of both PP and PET spunbond and like Hassan is now investing in an airthrough bonding line to chase the ADL market.

What’s interesting to note is the differing export situation for Turkish textiles and its hygienic disposables.

ITKIB reports that Turkey has invested $106 billion in its textile manufacturing infrastructure between 1990 and 2011, and in 2011 47% of textile exports went to EU countries, followed by 13% to Russia.

By contrast, of the estimated four billion diapers produced in Turkey in 2010 with a value of around €579 million, 50% were exported, but the main markets for them were Iraq, Iran, Syria, North Africa and East Europe.

So while the country has traditionally been referred to as the bridge between Europe and Asia, the eventual destination for a significant amount of the converted nonwovens that now leave Turkey are now going to the countries of the rapidly growing MENA (Middle East & North Africa) region.

In addition to the EU, Turkey now has free trade agreements with 22 other countries.

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more