Composites Germany survey reveals positive industry outlook

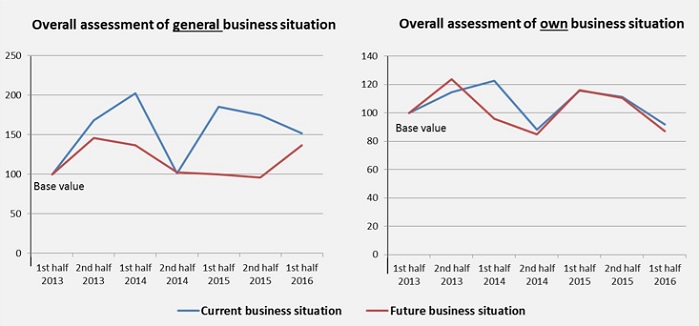

According to the survey, the assessment of both the general and specific business climates were less positive than in the last survey.

9th August 2016

Innovation in Textiles

|

Berlin

Composites Germany, trade association uniting four major organisations in the fibre composites sector, has announced the results of its seventh survey of the market for fibre reinforced plastics.

Once again, the questionnaire was sent to all member companies of Composites Germany’s four supporting associations: AVK, CCeV, CFK-Valley and VDMA Working Group Hybrid Lightweight Technologies. The number of participating companies was greater than ever before, with nearly 140 completed questionnaires returned.

According to the survey, the assessment of both the general and specific business climates were less positive than in the last survey in contrast to the positive evaluation of the general future business climate. The hope remains that an upward trend in the general market climate will lift each company individually and therefore the sector as a whole.

“As in the last survey, it is important to remember that the overall picture for the sector continues to be very positive despite the negative trend in the indices,” Composites Germany explained.

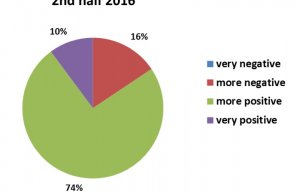

Participants were asked for their assessment of the general business climate in the three regions Germany, Europe and worldwide and their responses were extremely positive: more than 80% described the general business climate in all three regions as “generally positive” or “very positive”.

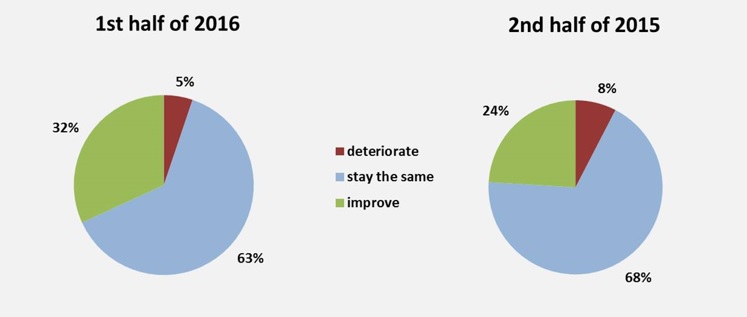

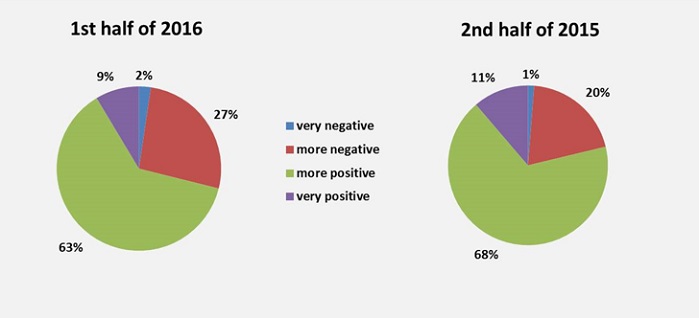

They also continue to be very hopeful for the general business climate in the near future. For example, 32% of those surveyed expect the general business climate to improve still further (+8% compared to the last survey) while only 5% expect conditions to worsen (-3%).

Respondents’ assessments of the general market are slightly more optimistic than those relating to their own business situations. The proportion of those surveyed who considered the position of their own company as generally positive or very positive in the worldwide market fell from 79% in the last survey to 72%. The picture for the regions of Europe and Germany is similar.

However, despite this slight fall it is important to note that ¾ of respondents still believe the current situation is positive for their own companies. Only 5% expect business to worsen going forward while 28% of those surveyed expect an improvement. For Europe and Germany these values are even higher at 29% and 33% respectively.

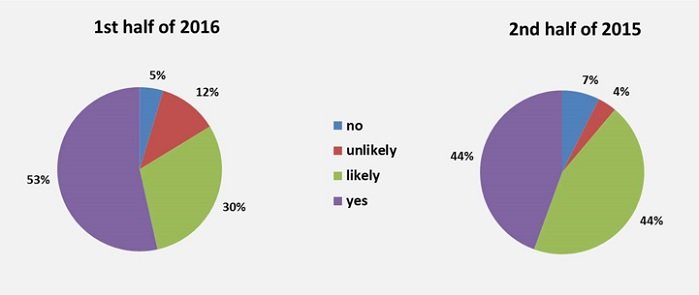

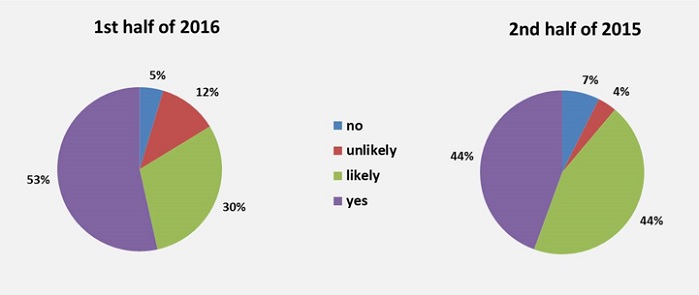

A similarly complex picture also emerges from the indicators for investment climate, human resources planning and machinery investment. While in the last survey 44% of respondents said they expected to invest in machinery, this increased to a current value of 53% in the latest edition. However, the number of companies not planning to invest in machinery or which consider such investments unlikely also rose.

“Nonetheless, it must also be noted that over half of those surveyed expect their companies to become more involved in the area of composites,” the survey states.

There were only small percentage changes in the growth drivers for the composites market. The automotive and aviation sectors remain the areas expected to deliver the strongest growth. Thirty nine percent of respondents again expect CRP to be the most important growth driver. However, the material suffered a significant decline (-11%). Forecasts for other materials remained constant or even rose, e.g. natural fibre reinforced plastics (+6%).

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more