Hugues Schellenberg elected new UCMTF President

Bruno Ameline discussed the global reach of the French machinery manufacturers and the growth of technical textiles.

5th November 2015

Innovation in Textiles

|

UK

Talking Heads is an Innovationintextiles.com column, which features interviews with the industry’s movers and shakers. In this Talking Heads Adrian Wilson interviewed UCMTF President Bruno Ameline, who discusses the global reach of the French machinery manufacturers and the growth of technical textiles.

UCMTF is a French Association of Textile Machinery Manufacturers, which covers a variety of sectors including machinery for spinning, winding and twisting, nonwovens machinery, technology for weaving, dyeing finishing, as well as the making-up industry, equipment for recycling, waste reduction and pollution prevention, air conditioning equipment and software.

BA: European textile machinery manufacturers are customer-oriented innovators, but I have no credentials to speak for all of them. As President of UCMTF, I can speak for 30 specialty textile machinery manufacturers, often world leaders in their specific markets, with a total annual consolidated turnover of €1 billion. They make France the sixth largest textile machinery exporter.

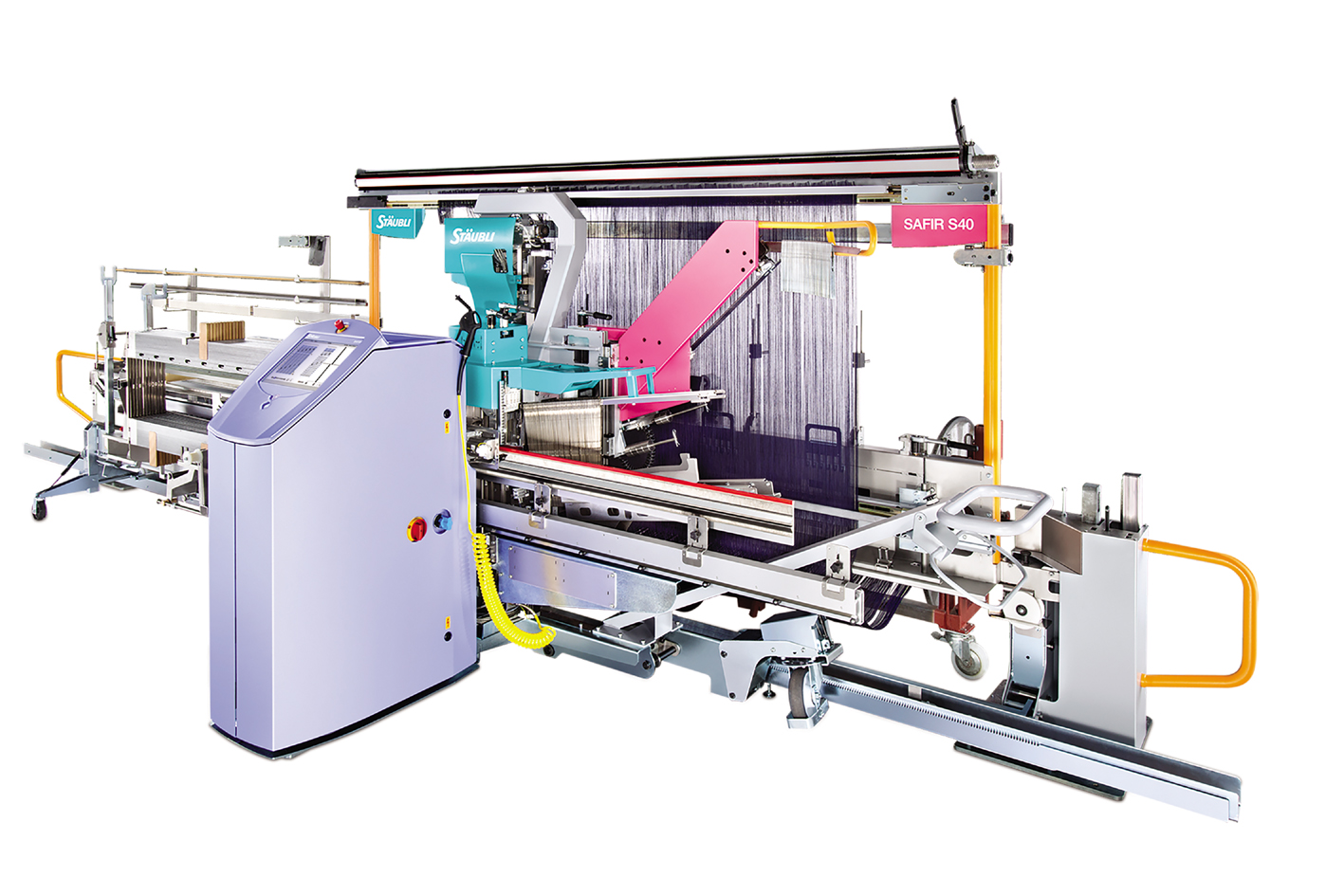

We are particularly strong in long fibre spinning, yarn twisting, heat setting and Jacquards and dobbies – Joseph Marie Jacquard, the most well-known textile machinery inventor, was himself French. Also, in carpet systems, dyeing and finishing, felts and belts for finishing processes, nonwovens, air and recycling processes.

We are SMEs run by entrepreneurs and innovation now stems mainly from down-to-earth partnerships with our clients. In addition, we have set up very effective networks to offer the best service to most remote customer locations. We support our clients wherever they operate. We do it through our own local teams and service centres, agents or distributors. For the spare parts, our members have been pro-active in opening centres in important markets to deliver parts without transportation or customs delays.

We work with our clients to help them to introduce new products on their markets, to have reliable, cost and energy efficient production processes.

These things give us a real competitive advantage and will help us continue to achieve success in the coming years and beyond.

BA: Technical textiles pave the way to so many new applications and are growing at a fast rate. It’s an impressive sector and I see this trend continuing for a long time thanks to innovative new fibres and textile processes which can offer new solutions to many industrial needs. Look at aerospace – it’s probably the industrial sector with the longest order backlogs, as long as ten years or more, and the number of planes which will be delivered in the next ten years will increase every year. The textile-based composites which make up more and more of their structures will increase at an even quicker pace. In many industrial sectors we do not have such visibility, but the use of technical textiles is increasing.

As far as we know, the percentage of all fibres already used in technical textiles is around 30% worldwide, it will increase year after year.

For technical textiles processes, many machines are not off-the-shelf, but have to be designed for a specific use. We can provide such service within long term partnerships.

BA: Markets are changing quickly but there are long term trends. One of these is the emergence of Asia for apparel and home textiles. I am very positive about India – the modernisation of its textile industry is crucial for its future but investments decisions have still been slower than we imagined.

Other Asian markets are still very active and the investment mood is still positive in many markets like Indonesia, Thailand and South Korea. However, the competitive devaluation of the Yuan, if amplified, may create a big challenge to these economies.

The US market is clearly recovering. Financing is abundant and the USA should become a positive market for our machines. This is actually already the case for some of our members who are active in specific applications like technical textiles, carpet manufacturing or recycling.

Key markets in South America like Brazil and Argentina are being severely hurt by their lingering economies and political instability. We are particularly disappointed by the Brazilian market.

Markets like Western Europe, Eastern Europe or Central Asia are doing quite well and we have been particularly active on such markets as Russia and Uzbekistan. We have signed cooperation agreements with the textile representatives of these two countries.

BA: China is our most important market. The economic uncertainty and financial turmoil which we are currently observing may lead to a real slowdown. It is hard to tell whether the slowdown will accelerate, if it will be a soft landing or whether growth and investments will rebound quickly. But these are only short term uncertainties. In the long run, I am quite sure the Chinese economy will continue to grow at a rate we would only dream of in many other parts of the world. If competition from other Asian economies is more aggressive on China’s main export markets, their home market will accelerate thanks to higher standards of living.

BA: The Turkish market has been very active so far, thanks to the long term managerial strategies of our Turkish customers, but the 2015 economic slowdown, the current political uncertainty and the sharp decrease of the Turkish currency create a clear reason for caution on their part.

Turkish textile producers are privately owned and very often family owned and managed companies with long term objectives. The French machinery manufacturers are very similar organisations. This helps us understand each other much better and establish long term partnerships which are clearly differentiating when times are more difficult.

BA: Iran is a real near-term opportunity for European textile equipment. Modernisation is urgent, the entrepreneurs are in the starting blocks and projects have advanced well since the Geneva agreement on the lifting of international sanctions. But financial circuits will take time to regularise. Soon, we will probably have more visibility on this promising market.

We have been proactive in Iran. During the rainy days, we have helped our customers run their factories, providing them with the necessary services and spare parts. When the sunny days come back, they will certainly remember. This is why we received such a welcome in June 2015, when we organised four conferences in Iran – in Tehran, Kashan, Ispahan and Yazd. In order to describe and present more precisely our offer, and for us to understand better the needs of new Iranian customers, we decided not to make a big event in one place but in four regional ones. The Iranian textile industry, which includes a very important carpet manufacturing industry, is a significant part of the Iranian economy. It is positioned on the high end market, focused on quality. To make up for the lack of recent investments, the Iranian textile industry, which has a well-educated work force, needs strategic partners. The French machinery manufacturers are well positioned to be such partners.

BA: Worldwide, textile manufacturers face an array of challenges – to open new markets, to design new products and to produce them in a reliable, cost effective and sustainable way. In order to sail in today’s fast changing environment, they need reliable partners to provide industrial solutions and cutting-edge technologies. French equipment manufacturers have the recognised expertise in finding solutions for critical projects – whatever their scope and wherever their geographic location. The quality of our client relationships also stems from the high stability of our teams, allowing them to go well beyond the purely technical.

We look forward to seeing all interested parties at our booths at ITMA 2015 in Milan.

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more