ACMA announces winners of second annual Composites Challenge

Mugsie founder Sid Gaffar on the challenges and opportunities of rising demand for American-made DTF apparel.

6th August 2025

Innovation in Textiles

|

California, USA

Walk into any custom apparel shop in the United States in 2025, and you’ll hear the same question from customers – “Can you make this with American-made components?”

It’s a question that stumps many printers because the supply chain for custom apparel has become increasingly global. While screen printing has established US suppliers for many components, DTF (Direct-to-Film) printing presents a unique opportunity – although not without certain challenges – for achieving true Made in USA production. The numbers tell the story. According to a Retail Brew survey cited by NetChoice, nearly 60% of US consumers are willing to pay premium prices for American-made products. This isn’t just patriotic sentiment – it’s driven by practical concerns.

Recent global disruptions have made businesses wary of overseas dependencies and local sourcing means predictable delivery times and fewer supply chain surprises. American manufacturing is also synonymous with quality control and consistency which are critical factors for custom apparel businesses, where reputation matters.

In addition, shorter shipping distances and stricter environmental standards appeal to eco-conscious consumers and customers increasingly want to support businesses that align with their values regarding worker treatment and fair wages.

For custom apparel businesses, this represents a significant opportunity to differentiate from competitors and command higher margins – if they can deliver genuine Made in USA production.

Imported components

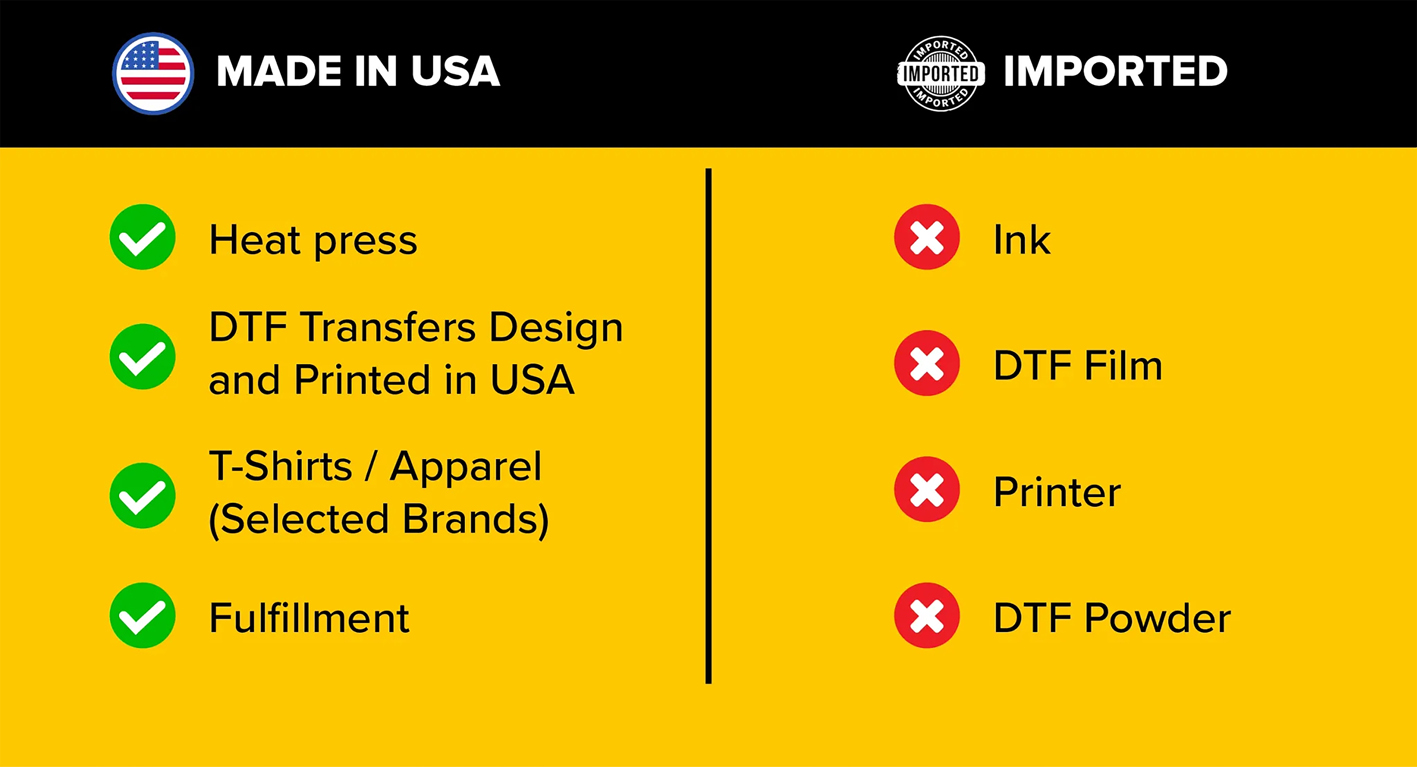

DTF printing, however, currently relies heavily on imported components, because unlike screen printing where domestic suppliers have had decades to establish themselves, it’s a relatively new technology dominated by Asian manufacturers.

DTF printers are currently manufactured primarily in China and Japan and companies like Japan-headquartered Epson dominate the modified printer market. Currently, no major US manufacturers produce DTF-specific inks and the specialised pigment formulations are sourced from companies in South Korea, China and Japan.

The PET transfer films essential to DTF printing are also imported from Asian suppliers, as are the hot-melt adhesive powders that make DTF transfers possible, primarily in China and South Korea. This might seem discouraging, but here’s where the opportunity lies – the most value-added and labour-intensive parts of DTF production can be executed domestically.

Heat presses

Heat press equipment is essential as the foundation of quality and manufacturers like Geo Knight of Massachusetts and HIX Corporation in Kansas produce commercial-grade heat presses that outperform imported alternatives in durability and consistency.

At Mugsie, we’ve operated the same American-made heat press for over seven years with zero mechanical failures. While a Chinese heat press might cost $800 compared to $2,400 for an American model, the total cost of ownership tells a different story. It’s essential to calculate the true cost including downtime, repairs and replacement frequency. A $1,600 price difference divided by seven years of reliable operation equals $228 annually and is easily justified by the business continuity value alone.

DTF printing services

While you can’t buy American-made DTF printers, you can ensure your DTF transfers are printed domestically. This is where businesses like Mugsie make the difference with all of its DTF transfers printed in California, supporting local jobs and enabling faster turnaround times. Domestic DTF printing offers several advantages including 24-48 hour turnaround instead of 1-2 weeks from overseas, direct communication with production teams and quality control you can visit and verify.

Premium American-made

There are also plenty of blank apparel options from companies such as American Apparel, Bayside Apparel and Continental Clothing.

Yes, American-made blanks cost more. A typical imported t-shirt might cost $2-4, while American-made versions range from $6-15. However, this premium can become a selling point rather than a cost burden when positioned correctly. Instead of absorbing the cost difference, it can be used as a differentiation point, marketed as ‘Premium American-Made Custom Apparel’ and priced accordingly. Customers willing to pay for Made in USA are typically less price-sensitive and more value-focused.

Applying DTF transfers, quality control, packaging, and shipping from US facilities completes the domestic production story. This is entirely within the marketer’s control and adds significant value.

US-based fulfilment means same-day or next-day shipping capabilities, English-speaking customer service during US business hours, easy returns and exchanges, and faster problem resolution.

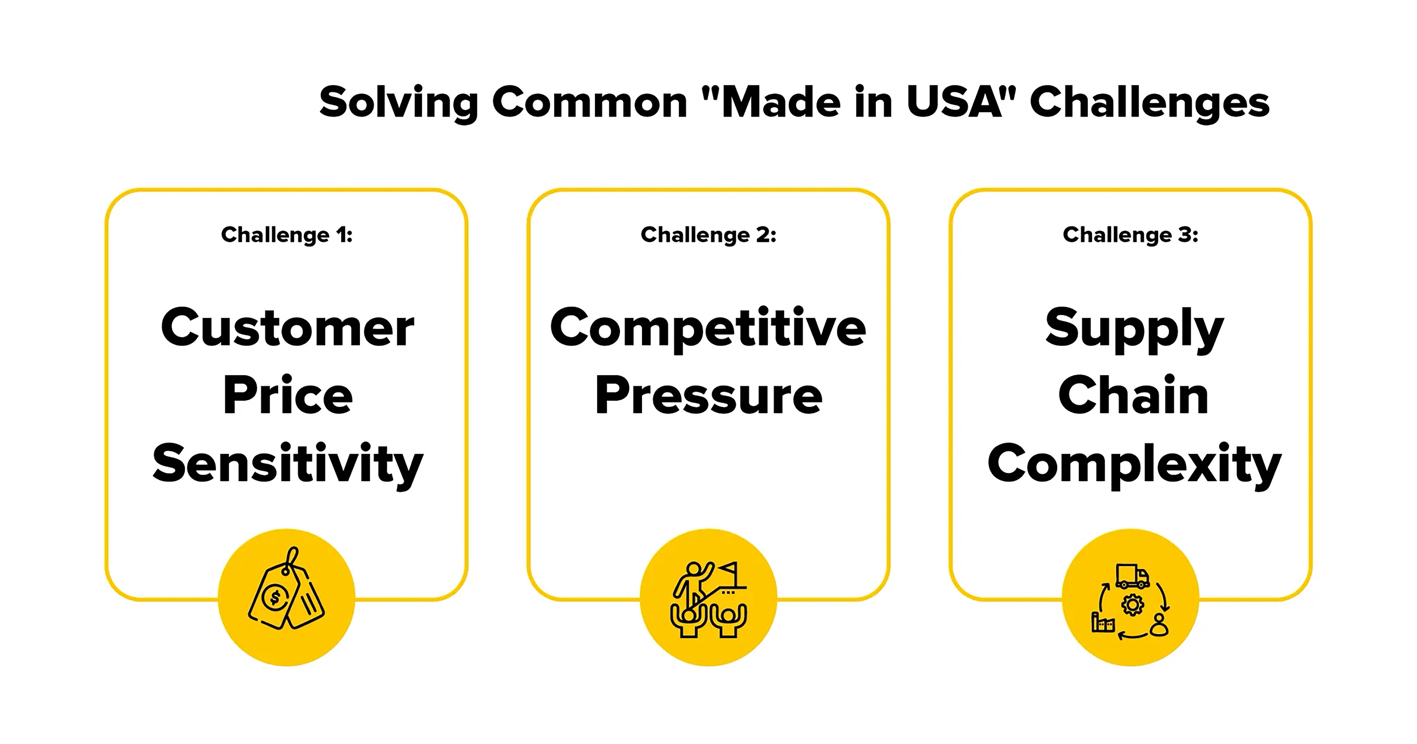

The keys to solving Made in USA challenges here then, are to create a comparison showing total value and to market to customers who prioritise quality, sustainability, and supporting American businesses.

To avoid supply chain complexity, it’s best to start with one product line as a “Made in USA” offering rather than converting everything at once, while building relationships gradually and learning from experience before expanding.

The financial reality

Looking at the real numbers for a typical custom t-shirt order, using the traditional DTF approach, an imported blank will cost around $3, an overseas DTF transfer $2 and domestic application/fulfilment $3 for a total cost of $8. With a selling price of $16, that’s a 50% margin.

With the Made in USA DTF approach, the US-made blank will cost $6, a domestic DTF transfer $3 and domestic application/fulfilment $3, for a total cost of $12. At a selling price of $20, the margin is $8 or 40%. While the margin percentage decreases slightly, the absolute dollar margin increases by 50%. More importantly, you’re serving a different market segment with different expectations and willingness to pay.

Implementation roadmap

I suggest the following implementation roadmap for new entrants to this business:

Phase 1: Test the Market (Months 1-2)

- Source American-made blanks for one product line

- Partner with a domestic DTF provider.

- Create Made in USA marketing materials

- Test customer response and pricing sensitivity

Phase 2: Optimise Operations (Months 3-6)

- Invest in American-made heat press equipment.

- Streamline domestic supplier relationships.

- Develop standard procedures for Made in USA production

Phase 3: Scale and Expand (Months 6+)

- Expand Made in USA offerings based on successful products

- Consider bringing DTF printing in-house with American labour

- Build Made in USA into your brand identity

Control

While you can’t source every DTF component domestically today, you can build a genuinely American DTF production workflow that serves growing market demand. The key is focusing on what you can control – domestic printing, American-made equipment, US-sourced blanks and local fulfilment.

The printers who succeed with Made in USA DTF won’t be those who wait for perfect domestic supply chains – they will be those who start now with available components and build their expertise and market position while the competition hesitates.

Start with what you can control, communicate transparently with customers about your American components, and build your Made in USA DTF capability one order at a time.

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more