Decathlon to establish unspun’s 3D weaving in Europe

Warning that the full weight of tariff pain is still to come, Walden Lam, co-founder of unspun argues that economics now backup the case for investing in near or on-shoring.

18th August 2025

Innovation in Textiles

|

San Francisco, CA, USA

Tariffs are no longer a threat – they’re a reality and the new normal.

As of August 7, 2025, default tariffs have officially kicked in following a short-lived 90-day pause.

For fashion, this isn’t just a policy update, it’s a full-scale supply chain reshuffle. Countries that have long underpinned global manufacturing including China, Bangladesh, India and Vietnam, are all facing elevated duties that add anywhere from $0.60 to $3 per garment, depending on category and FOB price (the ex-factory cost used to calculate tariffs).

While tariffs are applied at this manufacturer cost stage, the increase cascades through freight, wholesale and retail markups, so a $2 tariff at import can easily become $5-$7 more at the register.

Brands that had moved sourcing out of China in recent years are finding limited relief and even diversified supply chains are now under stress.

Evolving negotiations

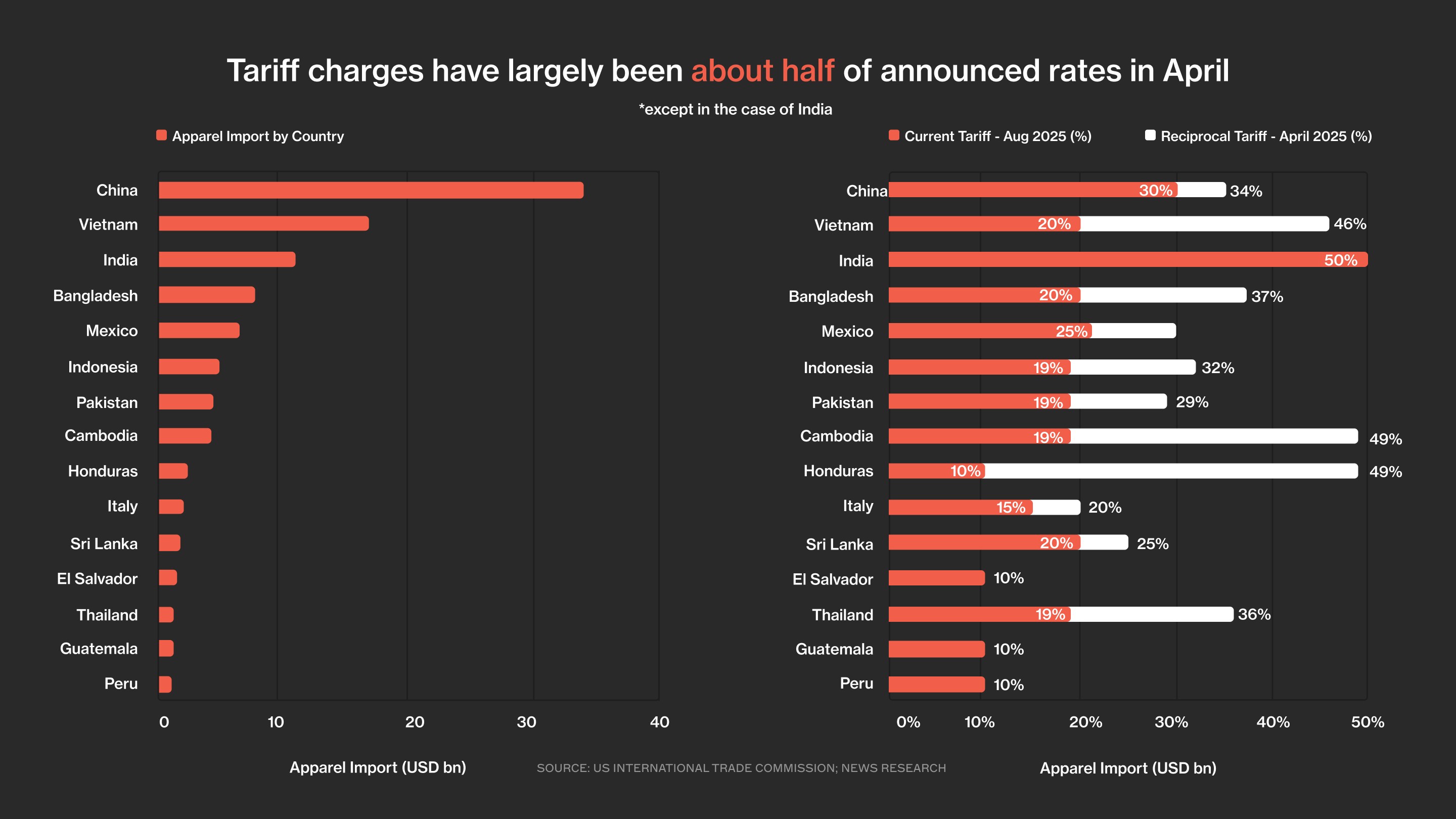

At unspun, we’ve been closely tracking the evolving negotiations across the largest apparel trade partners with the USA.

Out of the 15 most significant import sources, with the exception of China and India (which together accounted for over a quarter of US apparel imports in 2024), every other country has seen its effective tariff rate come down from the high 40s to below 20%.

If that feels like a win, it’s not. Not even close. That 20% is still hitting like a freight train.

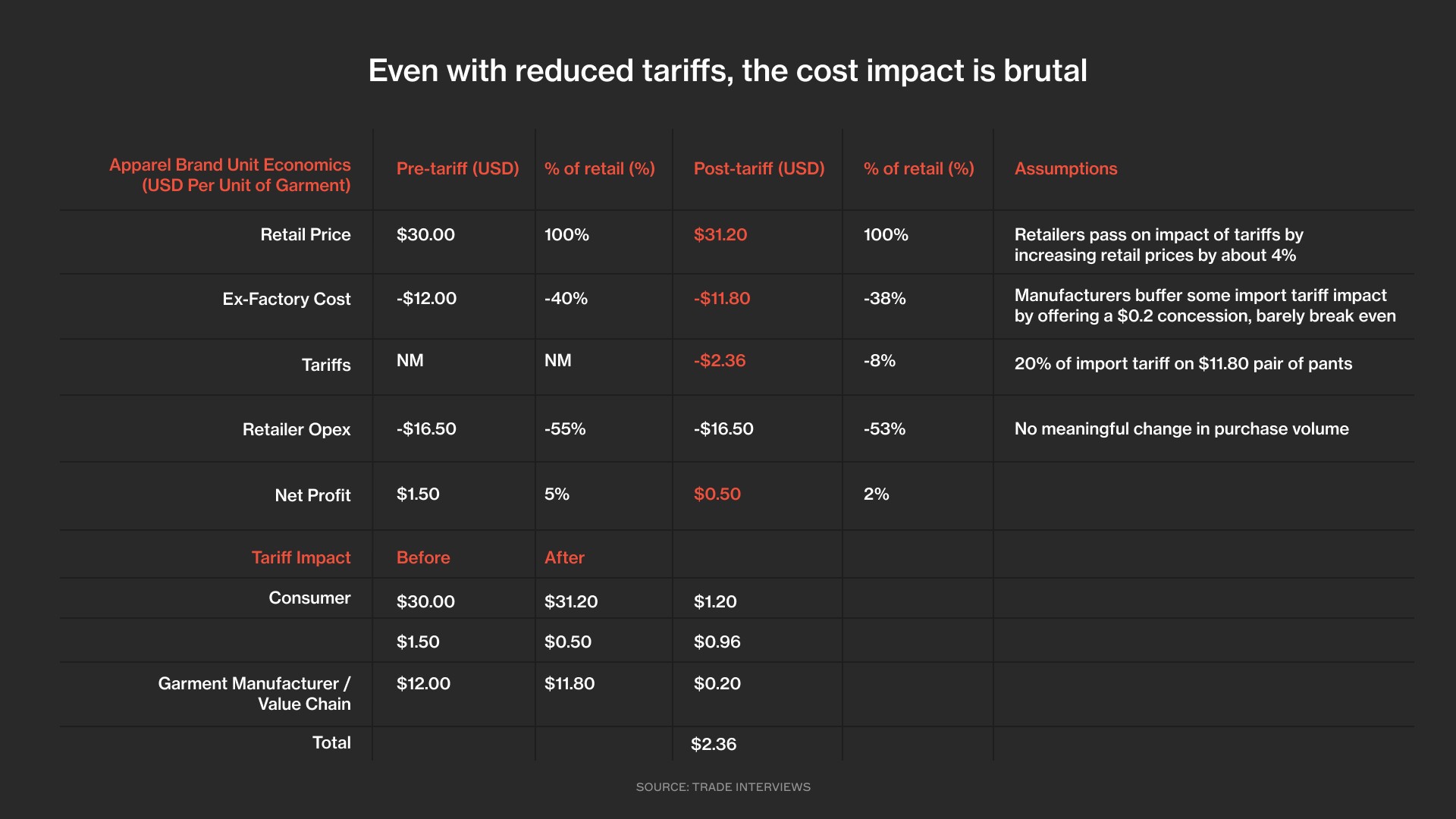

Using Bangladesh pants imports as a baseline, the new tariff structure still adds $2.36 in import fees on a $12 ex-factory pair of pants. Based on pricing data from Sourcing Journal and Dataweave, we’ve updated our assumptions.

Apparel prices are already up 2% and expected to rise another 2% and we believe consumers will shoulder around $1.20 in higher retail prices, while retailers will eat around $0.96 per unit, reducing their net margin from $1.50 to just $0.50 – a 66% collapse

Manufacturers will absorb around $0.20, eroding already razor-thin margins.

Flexibility the key

Some companies are still hedging, but forward-looking players are already in motion and doubling down on flexible production partners that can pivot across geographies without blinking. Flexibility is now a sourcing key performance indicator.

To skirt origin-based duties, some brands are also routing production through re-export centres, particularly in Indonesia and the UAE, a legal grey zone that is gaining traction fast.

Brands are negotiating aggressively with suppliers to absorb duties. It’s a short-term fix, but one that’s already testing the limits of supplier resilience and where they can, brands are also rolling out small, phased price increases to maintain margin without shocking consumers or losing share.

In addition, economics now backup the case for reinvesting in near-shoring and on-shoring. Brands are building or reviving local production across the US and EU to cut costs, time and risk.

Compounding drag

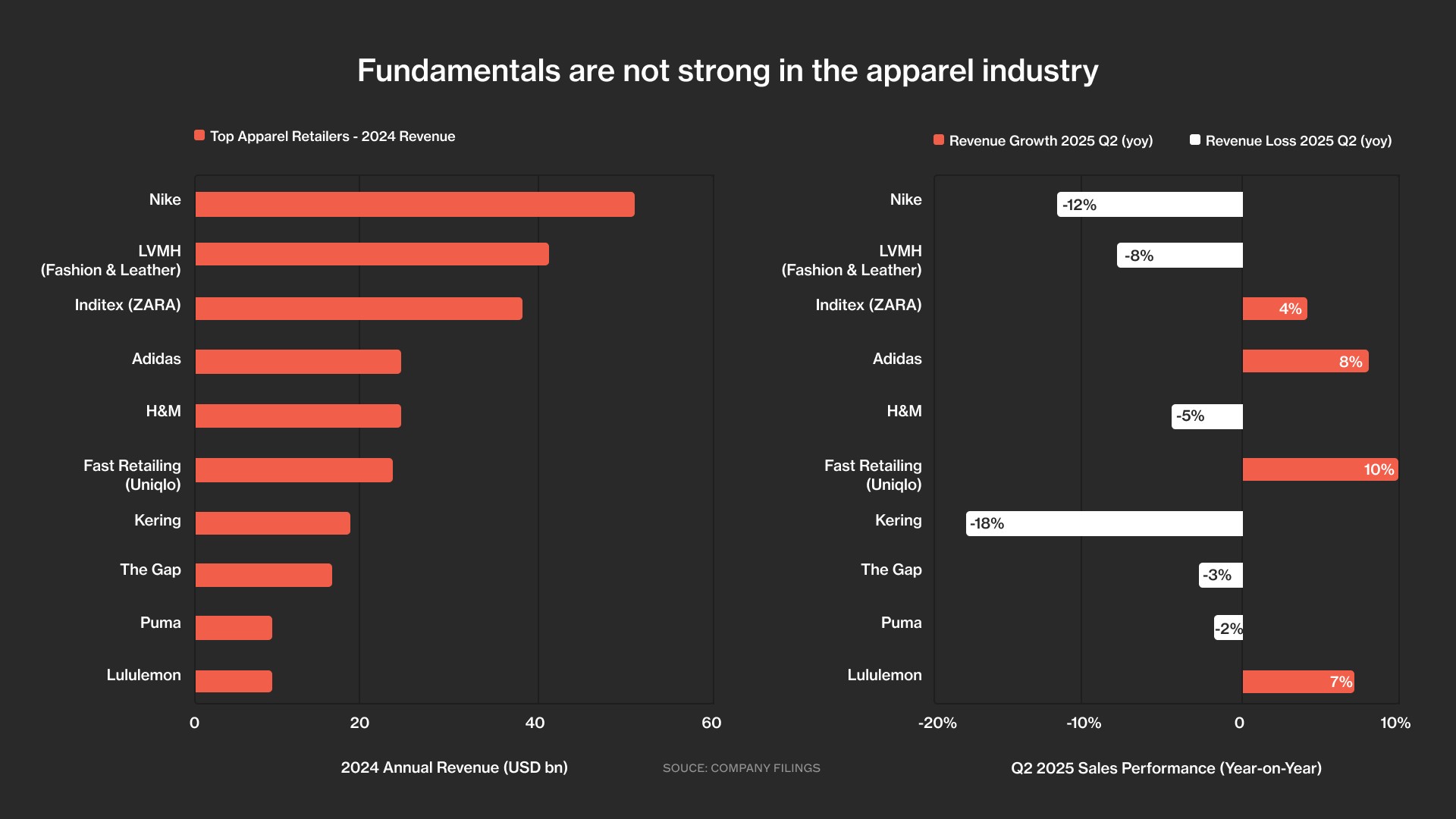

Even before the new tariffs, the apparel market was softening and data shows negative revenue growth for most major apparel players.

With most goods still only subject to 10% reciprocal tariffs through the second quarter of 2025, the full weight of tariff pain is still incoming.

For brands taking a ‘wait-and-see’ approach, the risk isn’t just higher tariffs. It’s the compounding drag of inflexible supply chains, including inventory piling up, discount cycles kicking in, slow sell-through cycles and capital tied up in transit and warehousing.

Tariffs are exposing the structural weakness of legacy operating models. Adaptability isn’t a bonus – it’s now essential.

Companies leaning into localised production aren’t just avoiding tariffs, they’re also gaining consumer trust, building brand value and creating faster, more responsive systems.

While the absolute tariff rates are painful, relative positioning is driving strategic shifts.

Most of Asia – Vietnam, Bangladesh, Indonesia, Pakistan – is now in the 19-20% tariff band. If countries like China or India manage to negotiate a drop to 15%, that’s $0.60 off per item which is enough to shift the balance. Latin America is rising – countries with 10% tariffs like Honduras, El Salvador, Guatemala, and Peru are attracting serious attention.

Industry consolidation ahead

Closed-door conversations with brands and suppliers suggest we’re entering a consolidation phase where retailers want to work with fewer, geographically flexible partners and financial pressure will force smaller manufacturers out, especially those unable to absorb tariff pain or shift production.

This is survival of the most adaptable.

Examples from around the world show what’s working, including On’s LightSpray automated microfactory in Zurich that manufactures all performance running shoe uppers directly in Switzerland using fully automated, industrially scalable processes.

Decathlon is meanwhile investing in modular manufacturing hubs across Europe for decentralized and near-shored production and Boss is leaning into Made-in-Germany production to gain full control and speed-to-market.

Onshoring supply chains

To stay competitive, especially with localisation and nearshoring on the rise, brands need speed, agility and automation built into their supply chains.

In July, we made the fastest pants in the world under one roof. Using our Vega 3D weaving platform, we went from yarn to finished garment in just 20 minutes.

We built Vega to unlock localised manufacturing at scale and it’s not a prototype, it’s proven. We’re ready to scale to over one million units in the next 12 months.

From our pilot facility in California to upcoming full-scale rollouts in the US and Europe, Vega replaces weeks-long lead times with real-time production.

Our time studies show that pants made with Vega can be assembled in half the time it would take a standard production process for the same design, and 6-10 times faster when compared to 3D knitting.

That time advantage will grow as the system evolves and brands that work with us can shift geographies, adapt fast and cut time-to-market without compromising on quality or cost.

Supply Chain Resilience Consortium

We believe no brand should face today’s tariff shocks or tomorrow’s policy shifts alone which is why we’re launching the Supply Chain Resilience Consortium this September – an industry initiative to build shared infrastructure for automated, regional production.

The consortium brings together forward-thinking brands and manufacturing partners around a common goal – to accelerate flexible manufacturing and deploy real-time software that makes global supply chains more responsive and resilient.

We’ve already committed a significant portion of funding to help onboard brands and manufacturing partners into this new production model and we’re backed by years of policy research and regulatory engagement in both the US and EU.

Together, we can build and share regional manufacturing infrastructure, reduce dependence on long-haul, multi-month supply chains, adopt automated systems that cut costs and carbon and align with new policy frameworks in the US and Europe

This is an open call. If you’re a brand or manufacturer ready to be part of a new era in apparel production contact us at [email protected].

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more