T-REX – latest EU recycling initiative

Opinion

Once technologies are fully mature, McKinsey estimates that 70% of textile waste could be fibre-to-fibre recycled.

26th July 2022

Adrian Wilson

|

Europe

McKinsey has published a new report entititled Scaling textile recycling in Europe—turning waste into value, which further ampifies the goals of the Euratex-led ReHubs project announced during a press conference at the recent Techtextil show in Frankfurt.

The report explains that today, more than 15 kilograms of textile waste is generated per person in Europe. The largest source of it is discarded clothes and home textiles from consumers – accounting for around 85% of the total waste.

The generation of textile waste is problematic, as incineration and landfills – both inside and outside Europe –are its primary end destinations. This has several negative consequences for people and the environment, but a significant transformation lies ahead that could create a large and sustainable new industry that turns waste into value.

Critical scale across the value chain is required to provide sufficient feedstock to the necessary fibre-to-fibre recycling technologies

There are multiple ways to address the waste problem, including the reduction of overproduction and overconsumption, the extension of product lifetime, and designing products for increased circularity.

Fibre-to-fibre

One of the most sustainable and scalable levers available is fibre-to-fibre recycling – turning textile waste into new fibres that are then used to create new clothes or other textile products.

This space is characterised by fast-paced innovation and a race toward scale. Some technologies, like the mechanical recycling of pure cotton, are already established. Others, like the chemical recycling of polyester, have been subject to intense R&D and are on the brink of commercialisation.

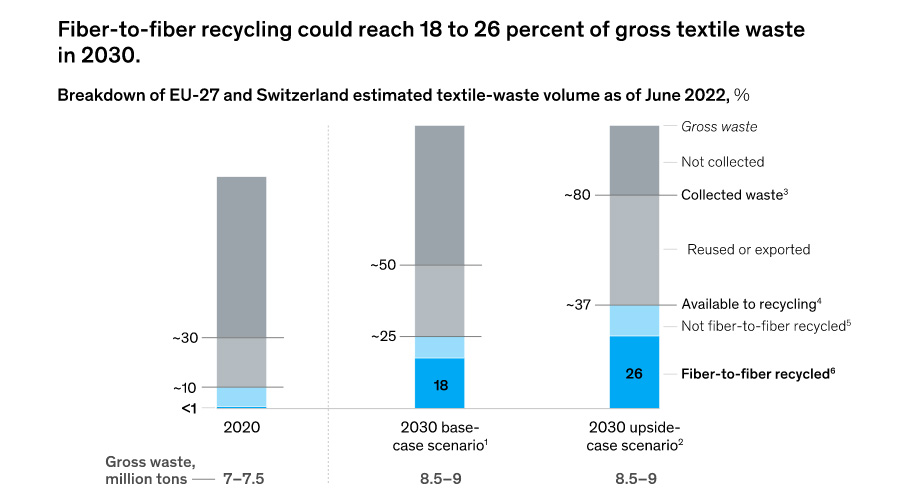

Once fully mature, McKinsey estimates indicate that 70% of textile waste could be fibre-to-fibre recycled. The remaining 30% would require open-loop recycling or other solutions like producing syngas through thermo-chemical recycling. However, today less than 1% of textile waste is fibre-to-fibre recycled due to several barriers to scale that need to be overcome.

Limitations

Collection, sorting, and preprocessing limit the amount of textile waste made available to fibre-to-fibre recycling. Collection rates are currently 30-35% on average, and a large share of the unsorted gross waste is exported outside Europe. Furthermore, most fibre-to-fibre recycling technologies have strict input requirements for fibre composition and purity – elastane, for example, is problematic for several of these technologies. Consequently, textile waste needs to be scanned and sorted according to the relevant input requirements.

As another example, jeans must have their zippers and buttons removed –a problem that needs to be solved by preprocessing. Advanced, accurate, and automated fibre sorting and preprocessing are not yet developed. Finally, to reach their full potential, the fibre-to-fibre recycling technologies must further expand their ability to handle fibre blends, lower their costs, and improve their output quality – these bottlenecks prevent the circular textile economy from scaling. The McKinsey analysis indicates that by overcoming these barriers, fibre-to-fibre recycling could reach 18-26% of gross textile waste in 2030, as illustrated in Table 1.

Capital

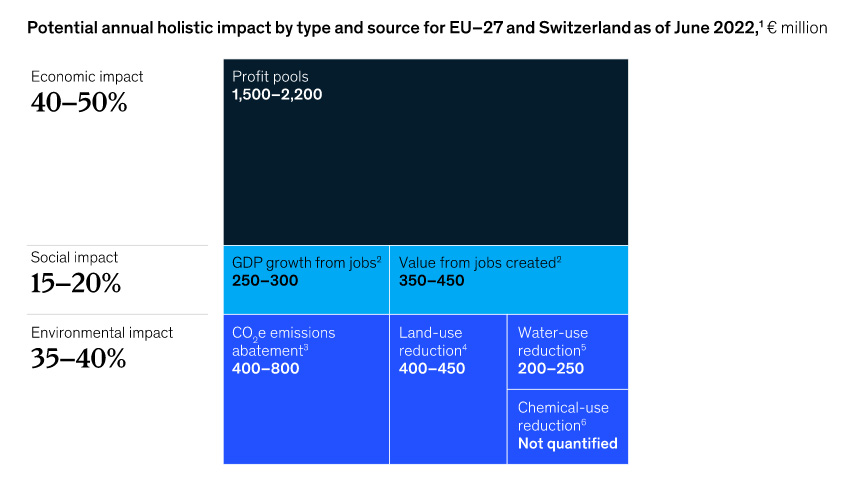

To reach this scale, McKinsey estimates that capital expenditure investments in the range of €6-7 billion would be needed by 2030. The entire value chain, including textile collection, sorting and recycling, requires investments to reach scale. The analysis indicates that this industry could – once it has matured and scaled –become a self-standing, profitable industry with a €1.5 billion to €2.2 billion profit pool by 2030. The textile recycling value chain could create a new, valuable raw material that enables more apparel production in Europe, which may lead to additional value creation above what is quantified in McKinsey’s report.

Beyond the direct economic benefits, scaling textile recycling unlocks several environmental and social benefits. For example, in a base-case scenario, about 15,000 new jobs could be created and CO2e emissions could be reduced by approximately 4 million tons –equivalent to the cumulative emissions of a country the size of Iceland. By quantifying into monetary terms several other impact dimensions like the secondary effects to GDP from job creation, CO2e-emission reduction, and water-and land-use reduction, the analysis shows that the industry could reach €3.5-4.5 billion in total annual holistic impact by 2030 – coming to an annual holistic impact return on investment of 55-70%, as shown in Table 2.

Success

The identified bottlenecks preventing scale are significant and will require several stakeholders to act boldly. Textile recycling in Europe will not reach a favorable state by 2030 unless major action is taken quickly.

McKinsey identifies five main ingredients for success:

-Critical scale. The textile recycling value chain cannot function at small scale. Critical scale across the value chain is required to provide sufficient feedstock to the necessary fibre-to-fibre recycling technologies, and to allow for those recycling technologies to operate at scale. Therefore, the industry must set bold scaling targets and meet them.

-Real collaboration. Several of the main challenges ahead are best solved in a highly collaborative manner. Business leaders across the value chain, investors, and leaders of public institutions would need to come together in an unprecedented way to engage in a highly operational joint effort to overcome the barriers to scale.

-Transition funding. Although the analysis indicates that the textiles recycling industry could – once it has matured and scaled –become self-standing and profitable, transition funding will be needed in the near term. Examples of such funding include subsidies –potentially Extended Producer Responsibility (EPR) funding and a green premium (potentially shared by brands and consumers). Public–private solutions may be needed.

-Investments. Several parts of the value chain must be built out almost from scratch, which requires significant capital expenditure. McKinsey’s analysis indicates that sufficient economic value can be realised to make up for the required risk. Private investors would lead this journey by taking initiative to finance building out the value chain.

-Public-sector push. Leaders of public-sector institutions would have to help drive textile recycling. Measures include driving up collection rates, limiting the export of unsorted textile waste, engaging in demand stimulation, creating harmonized frameworks for increased circularity, as well as other initiatives.

Foundation

Fibre-to-fibre recycling at scale can help address Europe’s waste problem by turning waste into value. The European apparel and textile industry can start expanding the required infrastructure for collection, sorting, and closed-loop recycling today. The McKinsey report establishes the opportunity at stake for textile circularity and highlights actions required to capture it. The author hope it can be a foundation for further research and collaboration to establish textile recycling at scale in Europe.

The full report can be downloaded here.

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more